Introducing Seed Fund III

Our third Seed Fund is a $30m fund that will invest in 30 early-stage NZ technology startups over the next three to four years.

IV Seed Fund III builds upon the momentum and experience we have as a result of investing in 288 startups since 2003. Our earlier seed funds were among the first investors in standouts including Mint Innovation, Dawn Aerospace, Halter, Sharesies, and First AML.

Seed III is an opportunity for wholesale investors to join us in backing this next generation-defining cohort.

What is “early-stage venture capital?”

Early-stage venture capital investing is when funds are invested in companies that are raising capital at a pre-seed to series A stage. That means capital will be deployed into companies that range from founders with a business plan who are ready to begin building their product and team, through to companies that have a proven track record who are looking to scale their operations globally.

.png?width=2240&name=IV%20seed%20III%20blog%20image%20(1).png)

Examples of companies that Icehouse Ventures invested in during their seed stage who have now scaled are:

- Mint Innovation who raised over $25m, have proven their technology in the prototype phase and are building their first commercial plant in Australia,

- Dawn Aerospace who have their technology commercially operating on multiple satellites in space,

- Halter who have raised over $60m and have grown to a team of over 100,

- Sharesies who have re-defined how Kiwi’s access and invest in the share market, scaling to over 450k users across NZ and Australia with plans for a third international market entry, and

- First AML who have raised over $60m to date and are doubling revenue every 12 months

Why IV Seed III?

The next generation of startups will be the largest, boldest, and most experienced New Zealand has ever seen. Many of tomorrow’s founders will have worked with and learned from today’s leaders like Halter (ex Rocket Lab), Mint Innovation (ex Lanzatech) and Sharesies (ex Xero), all of whom we backed when they first started.

Seed Fund III is benefiting from our time- and scale-based advantages. We have funded 288 startups to date, have $250m in funds under management, 1,500 investors, and a team of nearly 20. As one of the largest and most active seed stage investors in NZ, we are well placed to access and invest in many of the most promising startups moving forward.

This fund is about sticking to what we know and what we are known for- supporting great kiwi startups- and it is led by the same team who established and executed on our earlier seed funds (previously named Tuhua and Flux). This continuity enables us to leverage the insights, resources, and relationships we have.

Who is Icehouse Ventures?

Icehouse Ventures is a Kiwi venture capital firm that exists to back the bravest Kiwi founders, launching global companies from New Zealand. One start-up can define a generation. Our mission is to back them.

IV Seed Fund III helps by opening the door to investors who would like to invest in startups at their earliest stages and support innovative founders who have the potential to shake-up and positively shape the NZ (and global) tech landscape.

If you're interested in learning more about our history and meeting the team, check out our 'About us' page here.

Opening venture capital funds to new investors

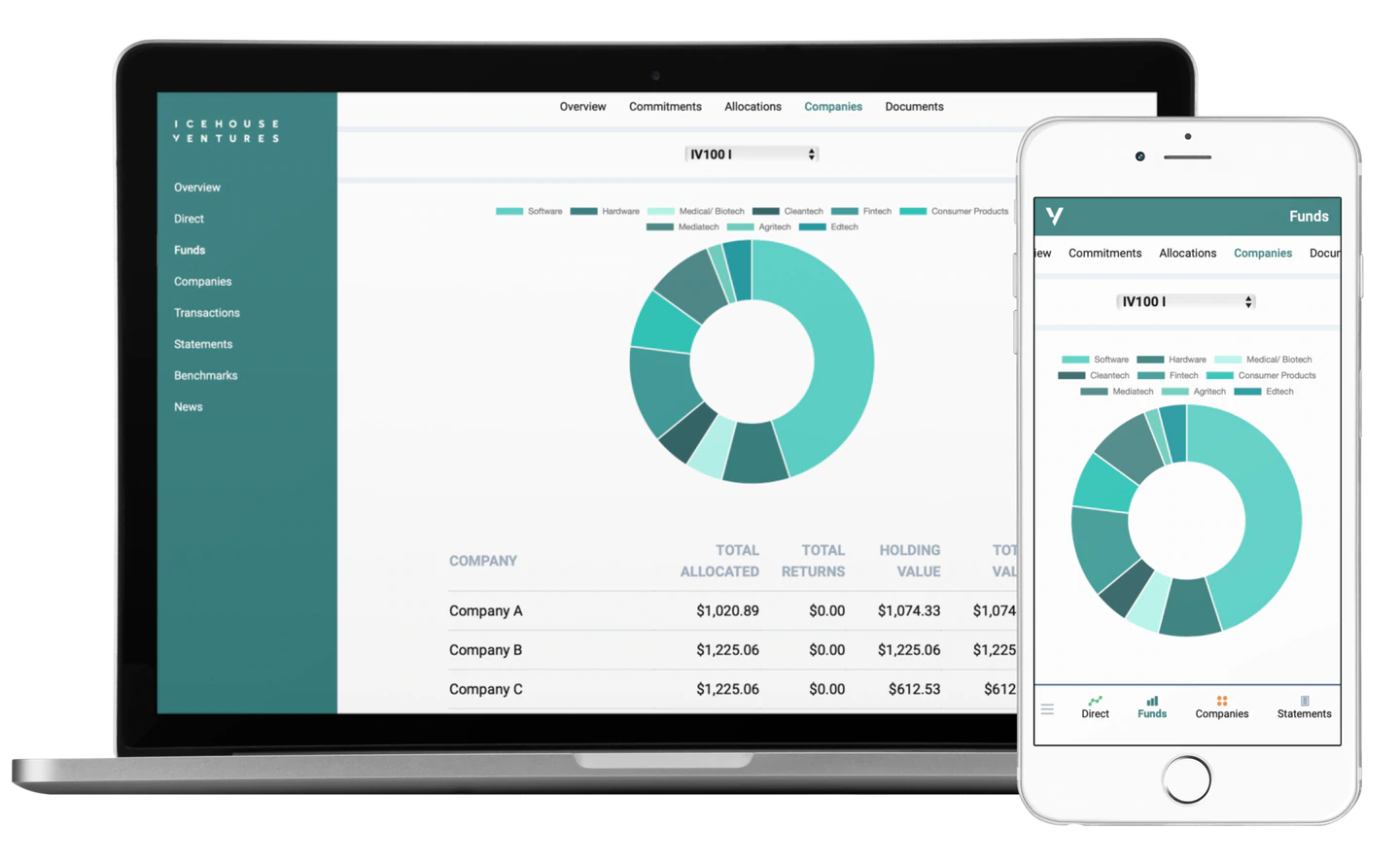

As with all of our funds, our objective is for investors to not simply feel informed. We want investors to be engaged. We achieve this with our immersive investor portal, annual events, engaging fund reports, and opportunities for investors to co-invest in specific companies they like.

Visit the fund information page or reach out to the Icehouse Ventures team to learn more about how to invest in the fund.

Who can invest in Icehouse Ventures funds?

Our funds are currently only available to ‘wholesale investors’, as identified by the Financial Markets Conduct Act 2013.

‘Wholesale investor’ is a term used in the Financial Markets Conduct Act 2013, to describe a person (or company, trust or partnership) that is legally allowed to invest in opportunities otherwise not available to the public or "retail" investors, like startups or venture capital funds. This restriction is designed to for investors' protection. Typically investments like startups and venture capital funds are higher risk and have less information or other protective rights than those able to be offer to the public or retail investors.

To qualify as a wholesale investor, there are a number of categories. Our investors typically qualify under one (or more) of four different options and they could be broadly described in two categories:

(1) Investors have appropriate experience to understand and accept the risks involved in the investment they are making,

or

(2) Investors have sufficient wealth to either afford appropriate professional advice or to withstand the losses they could incur.

Read the full description of a wholesale investor in our FAQ’s here. If you are unsure whether you may qualify, we recommend discussing this with your accountant or financial advisor.