New Zealand's reputation as an agricultural nation is well-earned. But beneath the surface, a different story is emerging. Our technology ecosystem has grown 10x over the past decade,* producing billion-dollar companies almost annually.

Often known as the golden visa pathway, the Active Investor Plus (AIP) visa offers a direct route to residency while gaining access to high-growth technology companies through venture capital.

This guide walks through how the AIP visa works and why New Zealand's venture capital market is compelling for investors. It also covers our AIP-approved funds and how we support investors through the visa pathway and into our community.

Understanding the New Zealand Active Investor Plus (AIP) Visa

The NZ Active Investor Plus (AIP) visa is designed for high-net-worth individuals to gain New Zealand residency.

Relaunched in 2025, it has replaced the 'Investor 2' visa. Its focus is attracting productive capital into New Zealand's growing innovation economy, rather than investments such as private credit or bonds.

There are two visa investment categories: Growth and Balanced. Both allow you to live, work, and study in NZ indefinitely, with a pathway to permanent residency. The key differences are the investment amount, time commitment, and asset flexibility.

Growth Category:

Invest a minimum of NZD $5 million in a New Zealand business or an approved managed fund.

Investments must be held for a minimum of three years, and visa recipients must spend at least 21 days in the country. They can travel in and out of NZ as a resident for four years before applying for a Permanent Resident Visa.

All growth category investments require approval from Invest New Zealand, an autonomous Crown entity established by the New Zealand Government.

Balanced Category:

Invest a minimum of NZD $10 million in New Zealand direct investments, listed equities, bonds, property developments (new or existing commercial or industrial developments, or new residential developments), or philanthropy.

Investments must be held for five years, and visa recipients must spend more than 105 days in New Zealand (reducible by 14 days for each additional $1M invested in growth investments, up to a maximum of 42 days). Visa recipients can travel in and out as a resident for six years, then apply for a Permanent Resident Visa.

Both AIP visa categories:

- Allow 6 months to transfer and invest the funds from the date of approval, with the option of a 6-month extension

- Do not have an English language requirement

- Include partner and dependent children aged 24 and younger

- Must prove a lawful source of funds and meet health and character requirements

See the full list of requirements on Immigration New Zealand’s website.

Why New Zealand is becoming a Technology Utopia

The New Zealand startup and technology ecosystem has evolved significantly over the past decade, creating compelling investment opportunities through the NZ AIP visa program.

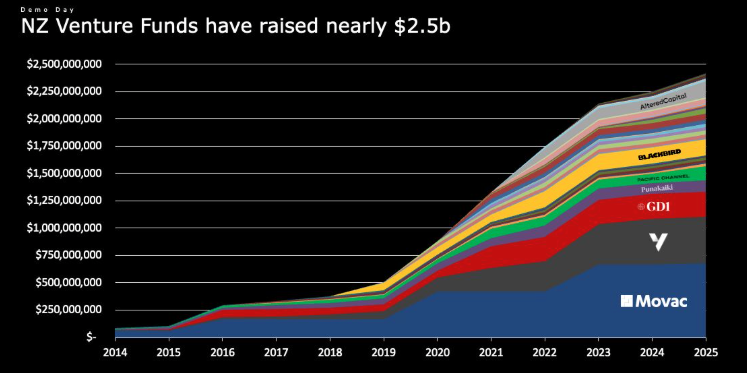

During this time, domestic venture capital funds have grown by ~10x from $250M to $2.5B*. Each year, ~120-160 venture backable companies raise ~$300M-400M in new capital, a figure that continues to climb.

Alongside these dedicated domestic venture capital funds, significant investment by international venture capital firms (BOND, VMG) and institutional investors (KiwiSaver providers, and family offices) suggests that capital available to NZ startups has likely grown by 20-40x in that period.*

Major KiwiSaver providers such as Simplicity, Generate, and Pie Funds have invested in NZ tech companies through Icehouse Ventures, both directly and through funds. More recently, Generate has made significant investments in Hnry and Halter – two leading Agritech and Fintech Kiwi companies.

Since 2015, billion-dollar companies have emerged almost annually, including Crimson Education, Halter, Sharesies, Dawn Aerospace, Partly and more. Notably, Crimson Education co-founders, Jamie Beaton and Fangzhou Jiang, grew the company to over $1 billion in aggregate revenue over 12 years, matching the trajectory of Kiwi success story Xero with less than a third of the funding.

New Zealand's unique advantages for AIP investors

New Zealand’s scale and culture offer distinct advantages that can make it an attractive market for venture investors and those considering the golden visa.

Comprehensive market visibility: New Zealand is a smaller market with 120-160 venture investments annually. As a result, investors have significantly better visibility into investment opportunities than in larger markets such as the US or China, where thousands of deals make it easier to miss or not have access to the same breadth of opportunities. This concentrated deal flow means investors can evaluate nearly every significant opportunity in the market.

Global-first founder mentality: New Zealand's small domestic market means founders can't rely on local scale alone. From day one, they're forced to think globally – designing products, teams, and go-to-market strategies for international expansion from inception. This constraint becomes an advantage: companies are built with global ambition baked in. Kami, Halter, Crimson Education, and Wukong Education have all taken a global-first approach and are now succeeding on the world stage.

The "New Zealand Inc." mentality: In New Zealand, a genuine collaborative spirit defines the innovation ecosystem. Founders, investors, and company operators are deeply committed to building for the long-term, supporting the next generation of entrepreneurs while building economically viable businesses. You can do good and do well.

For those exploring the investor visa NZ pathway, investing in venture capital gives you access to globally minded companies with strong fundamentals, backed by a maturing local ecosystem and growing international investor interest.

Venture Capital: Investment Return & Risk

Despite perceptions, investment in New Zealand’s economy, and specifically high-growth companies, carries less risk than some might assume. This perception of risk often stems from New Zealand's small market and geographic location, rather than from portfolio performance.

However, in reality, New Zealand’s concentrated market provides many beneficial insights: improved market visibility and our international-first founder mentality mean companies build diversified revenue streams across multiple geographies from early on, reducing single-market dependency.

Venture capital is a high-growth investment opportunity in New Zealand, and as a country, we have a strong proven track record of success, having founded the likes of Rocket Lab, Halter, and Xero.

As innovators and with our number 8 wire mentality, Kiwi companies are creating new industries while attracting highly skilled workforces at competitive salaries – all of which drive the New Zealand economy forward.

Take OpenStar Technologies, for example. OpenStar Technologies is a Māori-founded company based in Wellington that is creating a new fusion industry in New Zealand. They employ over 70 people, most of whom have actively chosen to relocate from abroad to work alongside founder Ratu Mataira at the forefront of fusion energy.

Icehouse Ventures fund risk profile

Icehouse Ventures offers portfolio options for different risk profiles and liquidity needs:

- Growth Funds: 5-7 year investment horizon

- Seed Funds: 7-10+ year investment horizon

Our funds offer extensive sector and industry diversification, with mild geographic diversification.

We are unable to specify the underlying companies (and by extension, the industries) that may be included in future funds or where capital remains to be fully invested. However, at a broader level, we invest in a wide range of sectors and industries, including SaaS, Hardware, Deeptech, Fintech, Medtech, Martech, and more.

Our investment ethos remains to invest in exceptional Kiwi-founded companies. Our funds’ underlying companies are primarily located in New Zealand, with some overseas, such as Wayve (UK-headquartered), Substack, and Nuro (both San Francisco-based).

In summary

The Active Investor Plus (AIP) visa provides a clear pathway to New Zealand residency while positioning investors to participate in one of the world's fastest-growing venture capital markets. With institutional capital flowing in, billion-dollar companies emerging regularly, and globally-minded founders building from New Zealand, the investment case is compelling.

At Icehouse Ventures, we are well-positioned to capture the next wave of growth opportunities from exceptional Kiwi-founded startups.

If you're interested in investing in AIP-approved funds with Icehouse Ventures, you can learn more and get in touch here.

*data as at June 2025.

Connect with Jason here.