New investment partners join The Icehouse to give massive boost to entrepreneurs and innovation

AUCKLAND, April 15, 2019: The Icehouse is powering up its impact on New Zealand entrepreneurs by today announcing new investment partners have come on board to form ‘Icehouse Ventures’, a new company to be launched 1 May that will accelerate the growth and development of Kiwi entrepreneurs with global aspirations.

The new partners include KiwiSaver funds manager Simplicity; Sir Stephen Tindall’s investment company K1W1; investment banking firm Jarden and investors connected to The Icehouse that will have a combined 23% stake in Icehouse Ventures.

Further, Simplicity has committed to invest up to $100 million over 5 years into funds managed by Icehouse Ventures that go into high growth New Zealand businesses seeking the next phase of expansion capital beyond early seed funding. A defining moment for New Zealand

Icehouse Chair Chris Quin says creating Icehouse Ventures is a defining moment for New Zealand’s startup sector: “This is a massive boost for entrepreneurs and innovation in this country. Together we are unlocking KiwiSaver and managed New Zealand funds to get more capital flowing into the growth sector to provide more support for New Zealand startups taking on global markets.

“Today also marks an evolution for The Icehouse as we bring on a group of investors who share our vision. We are excited about the potential of this partnership, and the opportunity to boost an already fast developing startup market in New Zealand that creates more local companies, jobs and allows more New Zealanders to benefit from their growth.

“Further, Icehouse Ventures will offer investors unprecedented portfolio-level exposure to New Zealand’s boldest start-ups.”

Fuelling more founders

Icehouse Ventures CEO Robbie Paul says the company is positioned to meet the demand of top calibre founders who have raised the bar in New Zealand: “The founders and leaders of our fast-growing young companies are understated heroes of this country, the backbone of the economy and the creative fibre of our future, solving real problems for better futures and better lives.

“We are seeing more second and third-time founders starting new companies; and with Icehouse Ventures and our new partners, we have this fantastic opportunity to step up and be a catalyst by providing greater amounts of capital over the next five to ten years to fuel their global ambitions.”

Closing the funding gap

Mr Paul says the company’s bigger scale will enable startups to attract significantly more capital by tapping into strategic offshore investors and also ensuring a greater portion of the capital they need can be provided by New Zealanders.

“Our goal is to ensure a greater portion of the capital that high growth companies need, can be provided by New Zealanders,” says Mr Paul. “We are delighted to share the ownership and commitment to this opportunity for New Zealand with our new partners in Simplicity, K1W1, FNZC and the other investors that join us on this journey.”

Simplicity Managing Director Sam Stubbs says the investment represents the first example of a KiwiSaver fund manager that is investing in a business dedicated to high growth New Zealand businesses.

“This is a fantastic opportunity for our KiwiSaver members to tap into a broad range of New Zealand’s boldest and brightest companies. Given the breadth and depth Icehouse Ventures has with companies starting up and expanding, we want to provide investment options for our members. We also think this is the beginning of significant investments by KiwiSaver managers into high growth New Zealand companies. It means every Kiwi can be a part of New Zealand’s exciting and fast-growing entrepreneurial sector.”

FNZC CEO James Lee said: “Our partnership with Icehouse Ventures is part of our firm’s broader investment into growing New Zealand’s capital markets. FNZC has a long history of supporting entrepreneurs and we’re excited to support a wider group of companies and people, connecting into our network of expertise and capital. We’re passionate about helping New Zealanders to succeed domestically and on the global stage.

For more information, please contact:

Julie Landry

Ph 021 895 098

FAQs

What is Icehouse Ventures?

Icehouse Ventures is an early stage venture capital firm. The firm includes all of the previous startup related activities of The Icehouse including the Flux Accelerator, partnerships with angel networks Ice Angels & ArcAngels; and funds Tuhua Ventures, Eden Ventures and First Cut Ventures, which collectively manage $50 million in funds. Tuhua Ventures second fund, Tuhua II is more than 75% subscribed and will close shortly.

More than $106 million has been invested into 165 New Zealand companies since The Icehouse first began channelling capital to startups with the establishment of its incubator in 2001 and Ice Angels in 2003, with more than half this amount raised within the past four years. In 2018, the Icehouse community invested $22 million into 56 startups.

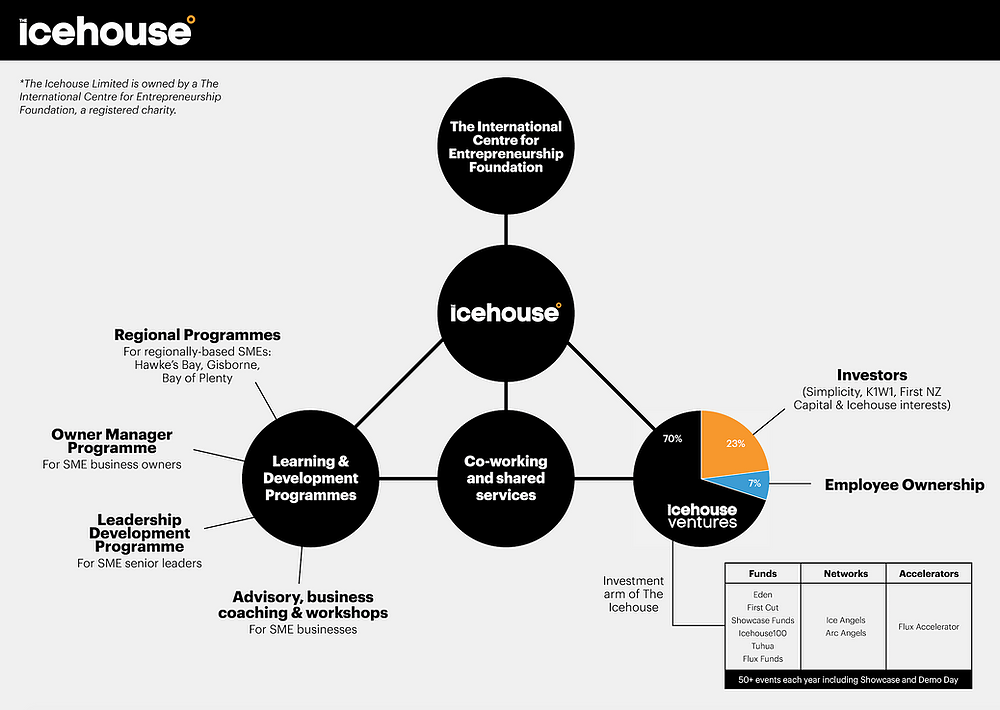

Icehouse Ventures will continue to be majority owned by The Icehouse Limited. New shareholders will include KiwiSaver funds manager Simplicity; Sir Stephen Tindall’s investment company K1W1; investment banking firm FNZC and a group of other investors and staff that will join with the partners.

How much are the new partners investing in Icehouse Ventures?

The Icehouse is raising $4 million to power up Icehouse Ventures and grow its business. The investing partners have committed $3 million of investment into Icehouse Ventures between Simplicity, FNZC and K1W1, leaving $1 million of investment to be raised from interests associated with The Icehouse. The investing partnership has also indicated they will be investing in Icehouse Ventures’ funds and investing platforms in their own right. Simplicity will start by investing $2 million into Tuhua Ventures’ second fund, Tuhua II and it expects to invest up to $100 million over the next 5 years in other Ventures funds that are funding emerging high growth New Zealand companies. FNZC will also be investing across the platform and also releasing products that enable its clients to access the portfolio opportunities of Icehouse Ventures best companies.

What is the ownership structure of Icehouse Ventures?

The new investing partners will own 23% of the company. The Icehouse owns the remaining shares and will be launching an employee share ownership programme.

Who is Robbie Paul? How did he become CEO?

Robbie joined The Icehouse in 2008 and trained under former US Angel Capital Association Director Dan Rosen and New Zealand Angel Association Arch Angel Bill Payne. He became CEO of Ice Angels in 2015. He is the Managing Partner of Tuhua Ventures and was a founding investor in 2016. He will take on the role of CEO of Icehouse Ventures from 1 May. You can find out more about Robbie here - https://www.linkedin.com/in/robertjpaul/

How many people does Icehouse Ventures employ?

Icehouse Ventures will initially employ 8 full-time executives who were previously employed by The Icehouse which now falls under the umbrella of Icehouse Ventures. More staff will be hired as the company grows.

How does the Icehouse work with Icehouse Ventures?

The Icehouse retains majority control of Icehouse Ventures and in simple terms, it is sharing a load of investment with its new investment partners to create more impact and returns. Everything else says the same, the organisation will work from the same place, acting as one business focused on supporting New Zealand’s founders and SMEs to reach their potential. The Icehouse will have a shared services contract with Icehouse Ventures to deliver its back office and compliance together with the support of marketing and executives such as The Icehouse CEO, Andy Hamilton who will continue to be actively involved in the Icehouse Ventures business and operations. This shared services arrangement has an initial period of five years. See diagram below.

What is The Icehouse?

Over the last 18 years, The Icehouse has principally focused on two target markets to achieve its vision. The first market it has worked with are established owner-manager firms or SMEs. The second market it has worked with are high-tech/high-value startups.

As the majority owner of Icehouse Ventures, The Icehouse will work closely with Icehouse Ventures while continuing to focus on the learning and development and coaching programmes developed for established SMEs. This includes a range of programmes such as the Owner Manager Programme and the Leadership Development Programme for owners and leaders of established SME businesses in the $3-100 million revenue category. The Icehouse is also expanding its regional footprint for support of established SMEs through its presence in Hawkes Bay.

Since 2001 its customers have created 27,285 new jobs and generated $15.5 billion of new revenue of which $3.7 billion is from international markets.